ZILHive Accelerator

This 30-year-old Serial Entrepreneur is Building the Plaid of DeFi

27 Oct 2021

Founded in 2013, $13 billion fintech giant Plaid revolutionized open banking. The company was one of the first to enable applications like Robinhood and Coinbase to connect with users’ bank accounts through open APIs.

Serial entrepreneur Tengku Muhammad Shah, who goes by the moniker “Moe”, hopes his latest venture can bring that same concept to the world of decentralized finance or DeFi.

Following the successful exit of a previous startup in Malaysia, Moe saw an opportunity to bring open banking to the region. Sensing a gap in the Southeast Asian fintech landscape, he started HeyAlfred in 2019 with the hopes of introducing the open banking concept pioneered by Plaid to local banks. Drawing inspiration from the billionaire vigilante’s butler, he hoped that HeyAlfred would become the go-to personal finance platform.

The startup initially secured seed funding from a few angel investors and a venture fund in Amsterdam to bring the idea to life. But after a year of trying to woo traditional banks, Moe quickly realized that banks in the region were less enthusiastic about the prospect of transparency. Moreover, they balked at the cost of having to revamp their legacy systems to support open APIs.

Moe and his team decided to rebrand to HeyAlfie last year, focusing on serving the needs of DeFi communities and platforms instead. Despite being a rapidly growing asset class built around openness and transparency, Moe saw few tools for people like him to manage their digital assets easily.

“I found it difficult to manage my assets across various DeFi platforms, wallets, and exchanges. That’s when I thought to myself: why don’t we apply the same principles of open banking to the DeFi space?” said Moe.

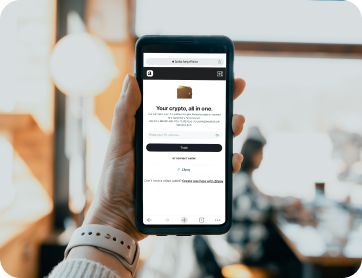

Today, HeyAlfie is on a mission to make DeFi easy to access by retail investors unfamiliar with decentralized exchanges or liquidity pools by providing a one-stop gateway to interact with smart contract platforms, as well as crypto exchanges.

HeyAlfie hopes to allow users to go beyond just helping users visualize and manage their portfolios. Moe explains that the team is working on features that will help users compare and find the best rates on different decentralized exchanges like Uniswap or ZILSwap.

Though the platform is still in its pilot stage, Moe is eager to see the team bring the product to market through the ZILHive Accelerator programme.

To learn more about ZILHive’s programmes, visit https://zilhive.org/.